President Trump has promised to create an age of American exceptionalism with policies that put the United States first, and ahead of other nations.

But Mr. Trump’s moves in the early days of his administration have had the opposite outcome for the American stock market.

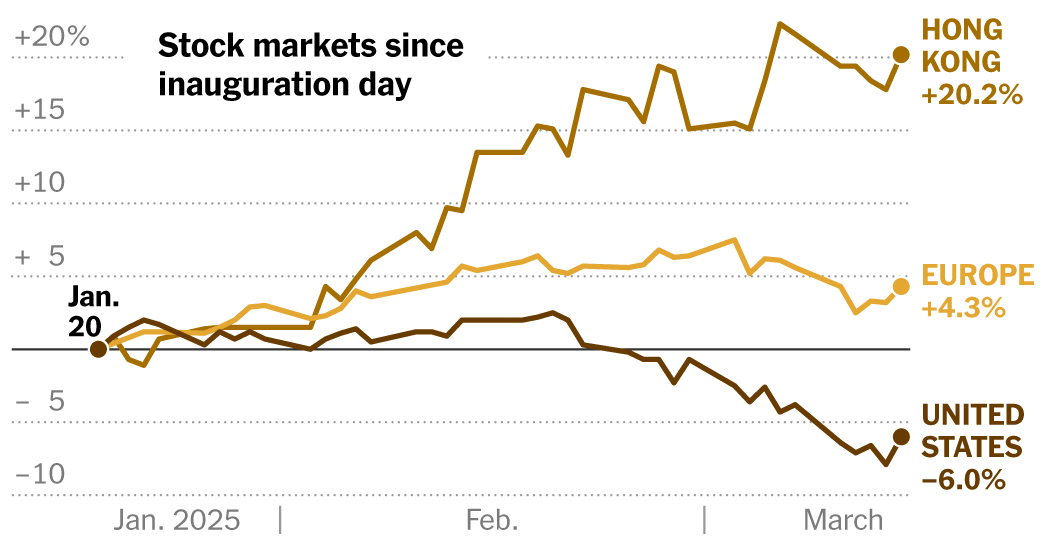

The S&P 500, which for years had been soaring above the stock indexes of other countries, is now trailing major markets in Europe and China, as investors have started to pull money from the United States and reallocate it around the world.

Since Mr. Trump’s inauguration, the S&P 500 has fallen 6 percent, while the Dax index in Germany has risen 10 percent and the Europe-wide Stoxx 600 index has gained more than 4 percent. Other U.S. indexes have fared even worse, as European markets have been buoyed by plans for military spending on the continent after Mr. Trump made it clear he wants those nations to do more to protect themselves.

The Hang Seng Index in Hong Kong has soared further, rising more than 20 percent since Mr. Trump took office in January, driven by the Chinese government’s efforts to stimulate its economy. Mexico’s IPC index, which is domestically focused and proving resilient to Mr. Trump’s steep tariffs, is 5 percent higher.

With American markets being whipsawed by the uncertainties over Mr. Trump’s tariff policies and deep cuts to the federal government, investment advisers have started steering clients to other stock markets around the world.

“It is definitely time to be looking at ex-U.S.,” said Jitania Kandhari, deputy chief investment officer of the solutions and multi-asset group at Morgan Stanley Investment Management. She said she had noticed an uptick in conversations with clients looking to increase their exposure to international stocks.

Even global markets that have slumped have managed to outperform the S&P 500. The FTSE All-World index has dropped 2.9 percent since the inauguration, weighed down by U.S.-listed stocks. Canada’s TSX index has dropped 2 percent. And the Japanese Nikkei 225 has fallen 3.6 percent.

In recent weeks, Wall Street has sent out a raft of bank research notes, client presentations and trade ideas that recommend a pivot away from the United States.

“Respect resilience, fade U.S. exceptionalism, and worry about policy shocks,” read the title of one of those presentations from Bruce Kasman, chief economist and global head of economic research at J.P. Morgan.

Brad Rutan, a market strategist at MFS Investment Management, said he also saw opportunities outside the United States. “It’s safe to say that there is plenty of room now for international equities.”

Over the past week, investors pulled money from funds that buy U.S. stocks for the first time this year, according to weekly data that runs through Wednesday from EPFR Global. The withdrawal totaled a modest $2.5 billion, which compares with the roughly $100 billion inflow in the first nine weeks of 2025.

While some traders are exceptionally quick to react to new information in the market, others, especially those that expect to be invested for a long time like pension funds or university endowments, can take months to move their money around.

“After such a protracted outperformance of the U.S. versus Europe, these things can’t turn 180 degrees in a month,” said Greg Boutle, head of U.S. equity and derivative strategy at BNP Paribas. “There are probably many investors that have not reallocated yet.”

If investors continue to pull their money from U.S. stocks and invest in foreign markets, it could add to the selling pressure that last week dragged the S&P 500 into correction, defined as a fall of more than 10 percent from its peak.

U.S. markets are so large that a complete exodus by foreign investors is near impossible, Ms. Kandhari said, “but the shift can definitely create market moves.”

The recent withdrawal comes after years when the U.S. stock market was the envy of the world, attracting foreign investors looking for higher returns than their home markets could provide.

Roughly $420 trillion flowed into funds that buy U.S. stocks in 2024, according to data from EPFR Global, helping lift major indexes higher and contributing to the growth of a handful of big technology companies. Roughly two-thirds of the valuation of the FTSE All-World Index comes from U.S. stocks, with nine of the top 10 stocks in the index by size coming from the United States.

In the year leading up to the presidential election, the S&P 500 outperformed many of the other indexes around the globe, rising 32 percent. The next best was Germany’s Dax, up 27 percent.

Many investors are still bullish on U.S. stocks over the long term and believe they will again outperform foreign stocks.

Europe may be ramping up government spending, potentially spurring growth. But that boom could be driven by a fear of war, not because of sustainable economic strength. And if the United States enters an economic downturn, the rest of the world is unlikely to be spared from the fallout.

“I think eventually all of this uncertainty settles down and we will still be left with a U.S. that has advantages that Europe and other countries don’t have,” said Paul Christopher, head of global market strategy at the Wells Fargo Investment Institute.

Other investors are wondering whether the current moment could be the beginning of an inflection point, upending the long-running trend of U.S. exceptionalism in financial markets.

“I think that discussion is happening,” Ms. Kandhari said.